Do accountants make good money?

CPAs are in demand across a range of industries. Practically every organization needs public accountants and auditors. Many CPAs also work as Tax professionals or business consultants; their expertise and training ensure that they can command high salaries.

Consequently, most companies do their best to retain their Accounting talent by providing regular salary hikes and bonuses. According to a survey conducted by the Association of International Certified Professional Accountants, newly qualified CPA with less than one year of work experience can expect to earn an annual salary of about 66 000. The average salary for CPA based in the United States is 119 000. Those CPAs who have extensive experience of working in Accounting and finance fields can earn substantially more. An individual with 20 years of experience could command an average of 152 000 in annual pay.

Its important to remember that these figures exclude bonuses, which could be in the range of 10 % of annual salaries. Additionally, CPAs can expect to earn pay increases of 4 % to 5 % every year. Of course, amount that CPAs make depends on a host of factors. The number of years of experience that you have, industries that you have worked IN, and the nature of work that you have handle, all play a role in determining your salary level.

CPA's work in various industries including

- Real Estate

- Advertising Agencies

- Sports and Fitness Center

- Fashion Industry

- Retail Business

- Amazon Sellers

- Manufacturing

- eBay Sellers

- Restaurants

- Shopify

Common duties of CPA include

- Environmental accounting

- International accounting

- Financial and tax planning

- Forensic accounting and assurance services

- Managing investments and expenses

- Performing audits and assisting

- Assisting Clients personal and professional financial goals

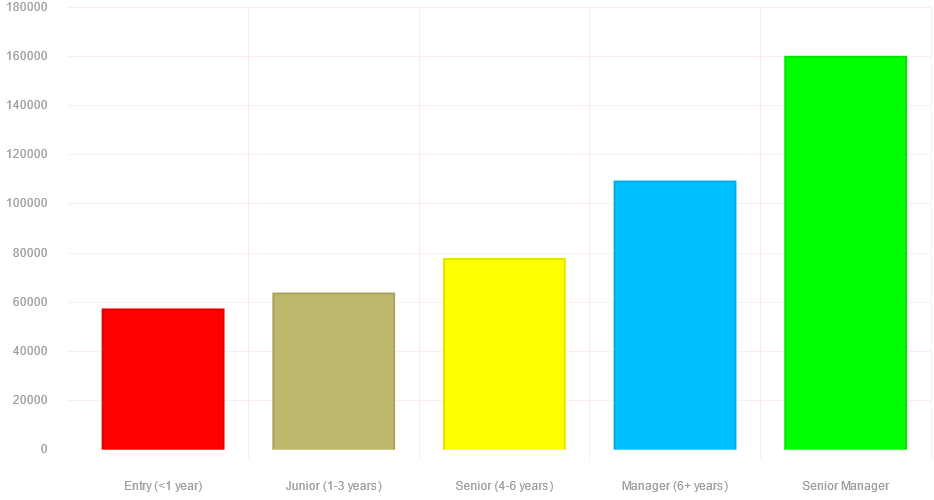

Average Public Accounting Salary Based on 2020 Robert Half Salary Guide ($)

Accountants and auditors

As mention, accountants and internal auditors are among high-demand financial services careers. As BLS notes, these professionals typically work full time in traditional office settings, primarily in accounting, tax preparation, bookkeeping, and payroll services.

Other opportunities for accountants and internal auditors also exist in government, insurance, and enterprise businesses, and some accountants are self-employ. In addition to organizing and maintaining financial reports, these professionals also handle tax preparations, financial assessments, and are responsible for maintaining internal accounting systems to ensure accuracy and efficiency.

Accountants and auditors will also make recommendations for reducing costs, boosting revenues, and improving financial operations. According to BLS, accountants and internal auditors earn median pay of 70 500 annually, but can increase to 74 690 in finance and insurance sectors. Individuals need at least a bachelor's degree to pursue these roles, although some employers prefer a masters degree, particularly for certified public accountant positions.

Best Outsourced Accounting Firm for CPA

Accounting outsourcing for CPA firms or accounting firms is very helpful as they can save cost, get experts output, reduce the workload of their accountants, provide effective work to their clients and so on. So, if accounting firms want to release some of their stress, then outsourcing is the right way to do that. However, to get an accounting outsourcing partner, accounting firms need to fully research and select the company like Rayvat Accounting which can assist them in any sort of services. To view the outsourcing services offered by us to accounting firms, you can visit our website or can quickly contact our team by email accounts@rayvat.com or can calling on +1 (888) 865-5255.

Comments

Post a Comment